Randy M.

Looking at your situation with a collection agency threatening to sue over $15K, here's what you need to know and do:

First, Don't Panic - This May Be a Bluff

An email threatening "small claims court" for $15,000 is likely either a scare tactic or shows the collector doesn't understand the legal process. Most states cap small claims court at $2,500 to $10,000, meaning they'd need to file in regular civil court for this amount - which is more expensive and time-consuming for them.

Most collection agencies don't actually take you to court. Law firms do that. Worst case scenario: Even if it went to court (and you were actually served papers from the court), you could just settle before trial.

Your Immediate Rights and Actions

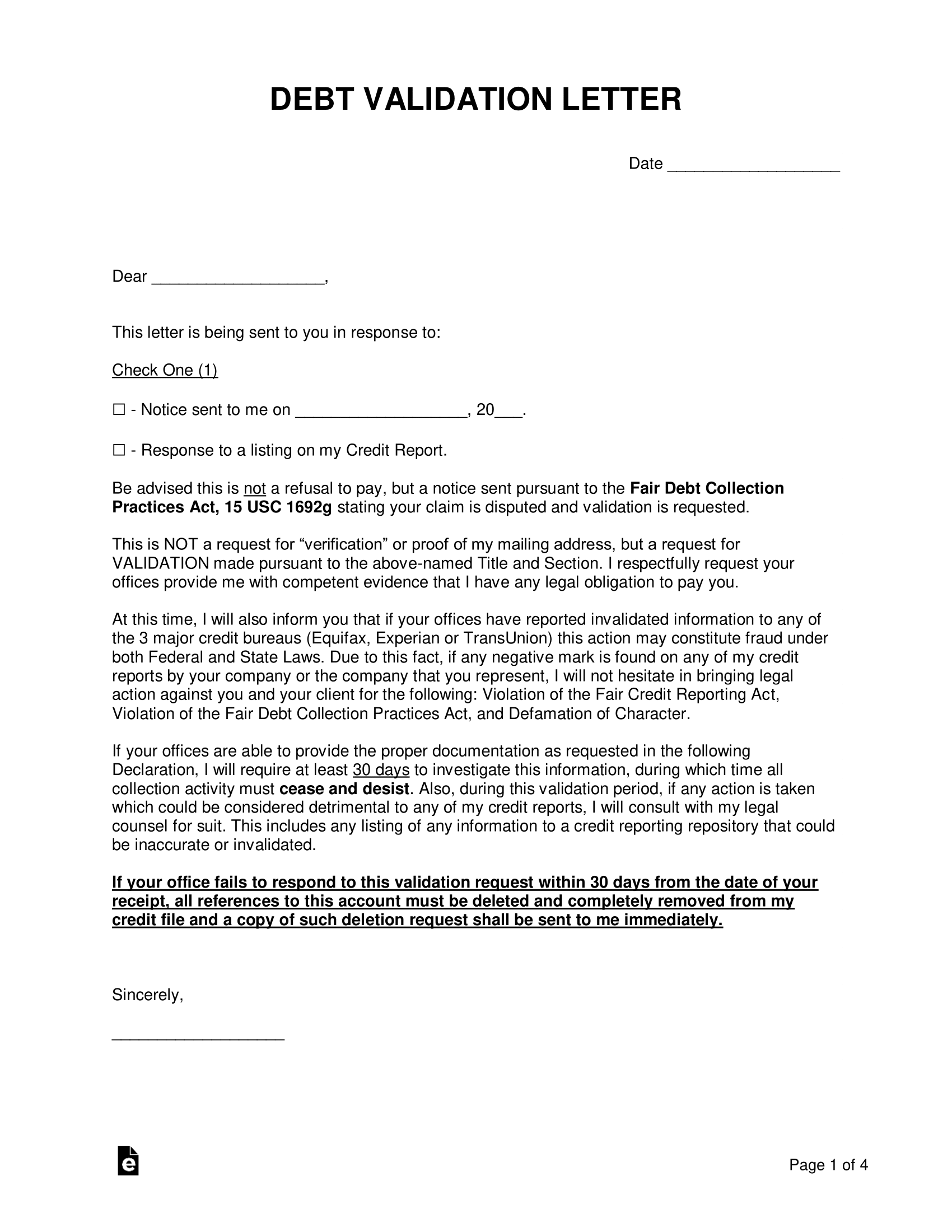

Under the Fair Debt Collection Practices Act, you have the right to demand written validation of this debt. Send them a certified letter (return receipt requested) within 30 days of their first contact asking for:

- Proof you actually owe this debt

- The original creditor's name and contact information

- The original debt amount and any added fees or interest

- Documentation proving they have legal authority to collect from you

Don't make any payments or acknowledge the debt until they provide this validation. Even a small payment can restart the statute of limitations clock.

Check If They Can Actually Sue You

Research your state's statute of limitations for debt collection. If this debt is old enough to be "time-barred," they legally cannot sue you, though they can still attempt collection. The timeframe varies by state and debt type, typically ranging from 3-6 years.

Settlement Strategy

If the debt is valid and within the statute of limitations, you have negotiating power. Collection agencies often buy debts for 10-20 cents on the dollar, so they may accept 30-50% of the claimed amount, especially for a lump sum payment.

When negotiating:

- Start with a lower offer than you can actually afford

- Get everything in writing before paying anything

- Ensure the written agreement states the settlement satisfies the debt "in full"

- Never give them electronic access to your bank accounts

- Ask them to report the account as "paid" rather than "settled for less" if possible

Red Flags to Watch

Verify this is a legitimate collection agency by checking with your state's Attorney General office, the Better Business Bureau, or the Consumer Financial Protection Bureau. Scammers often use lawsuit threats to create urgency.

If You Get Served with Actual Legal Papers

Don't ignore a real court summons. You'll typically have 20-30 days to respond. Failure to respond results in a default judgment against you. At that point, they can garnish wages or freeze bank accounts depending on your state's laws.

Consider consulting a consumer law attorney in your area if:

- You receive an actual court summons

- The debt isn't yours or seems inflated

- The collector is using harassment tactics

- You're unsure about your rights or the negotiation process

Sample Debt Validation Letter - Send this via certified mail:

"I am writing regarding account number [X]. Under the Fair Debt Collection Practices Act, I request written validation of this alleged debt, including proof of the original debt amount, the original creditor, and your legal authority to collect. I also dispute this debt and request you cease collection activities until validation is provided. All future communication should be in writing to this address."

Don't let the lawsuit threat pressure you into hasty decisions. Many collection agencies rely on fear tactics rather than actual legal action. Take time to validate the debt, understand your rights, and negotiate from a position of knowledge.

Helpful Resources:

- Fair Debt Collection Practices Act (FDCPA): 15 U.S.C. §1692 - Federal law governing debt collector behavior

- Consumer Financial Protection Bureau: www.consumerfinance.gov - File complaints against debt collectors

- National Association of Consumer Advocates: www.consumeradvocates.org - Find consumer law attorneys

- Legal Aid: www.lsc.gov - Free legal assistance based on income

- State Attorney General Offices: www.naag.org - Research collection agency licensing and file complaints

- Small Claims Court Limits by State: Available through your state court system website

- Statute of Limitations by State: Generally found through your state's consumer protection division

For immediate assistance, contact the Consumer Financial Protection Bureau at 1-855-411-2372 or your state's consumer protection hotline.