[OR] Does an attorney need to review a notarized certificate of trust?

0

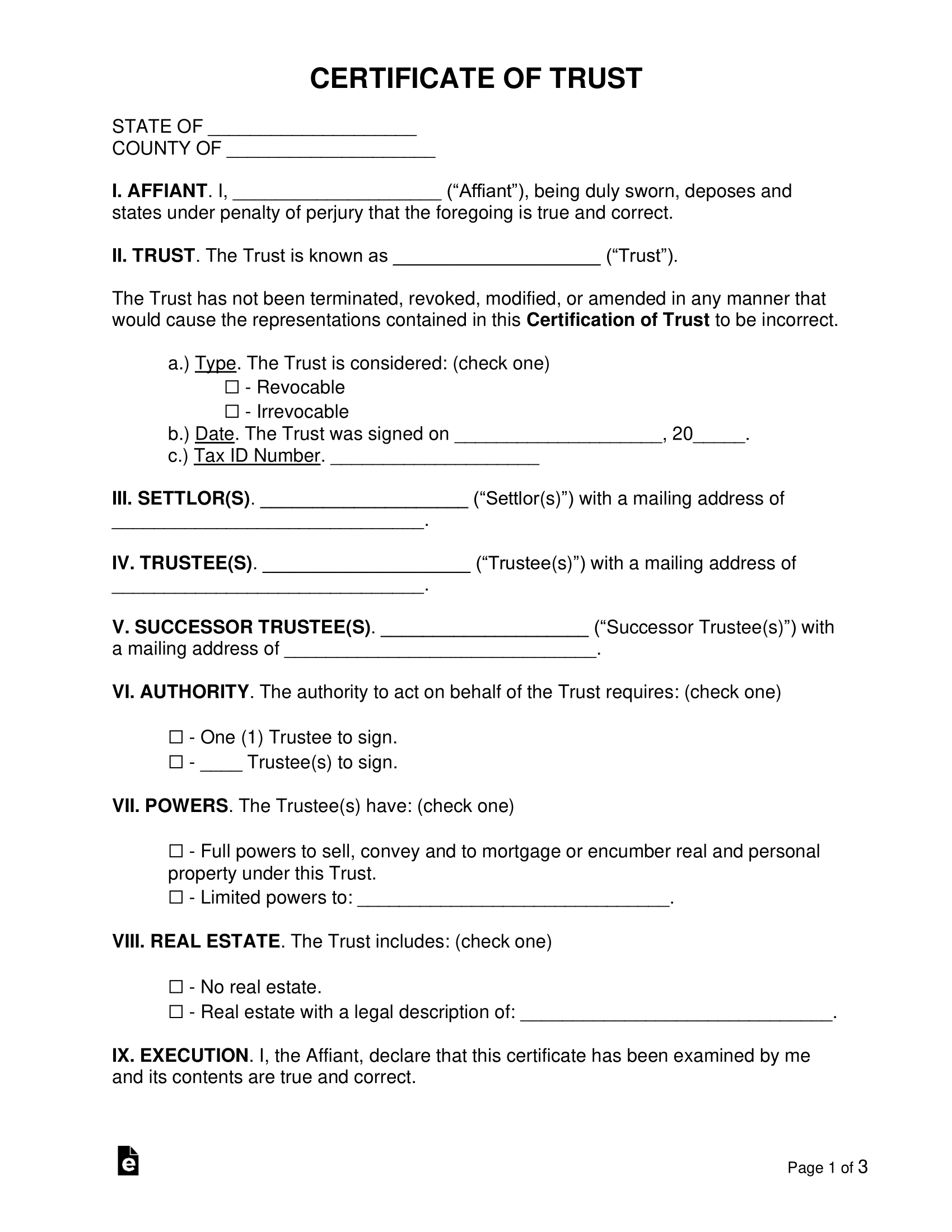

Official Certificate of Trust

Full Conversation

Disclaimer

By messaging AskaLawyer.com, you agree to our Terms and have read our Privacy Policy.

The information provided on AskaLawyer.com is for general informational purposes only and does not constitute legal advice. While we strive to ensure the accuracy and timeliness of the information presented, we make no guarantees regarding its completeness or applicability to your specific circumstances.

Use of this website does not create an attorney-client relationship between you and AskaLawyer.com or any of its attorneys. Communications through this website, including any responses from attorneys, are not privileged or confidential. For advice tailored to your individual situation, we recommend consulting a licensed attorney in your jurisdiction.

AskaLawyer.com disclaims any liability for actions taken or not taken based on the content of this site. We are not responsible for any third-party content that may be accessed through this website. Reliance on any information provided herein is solely at your own risk.